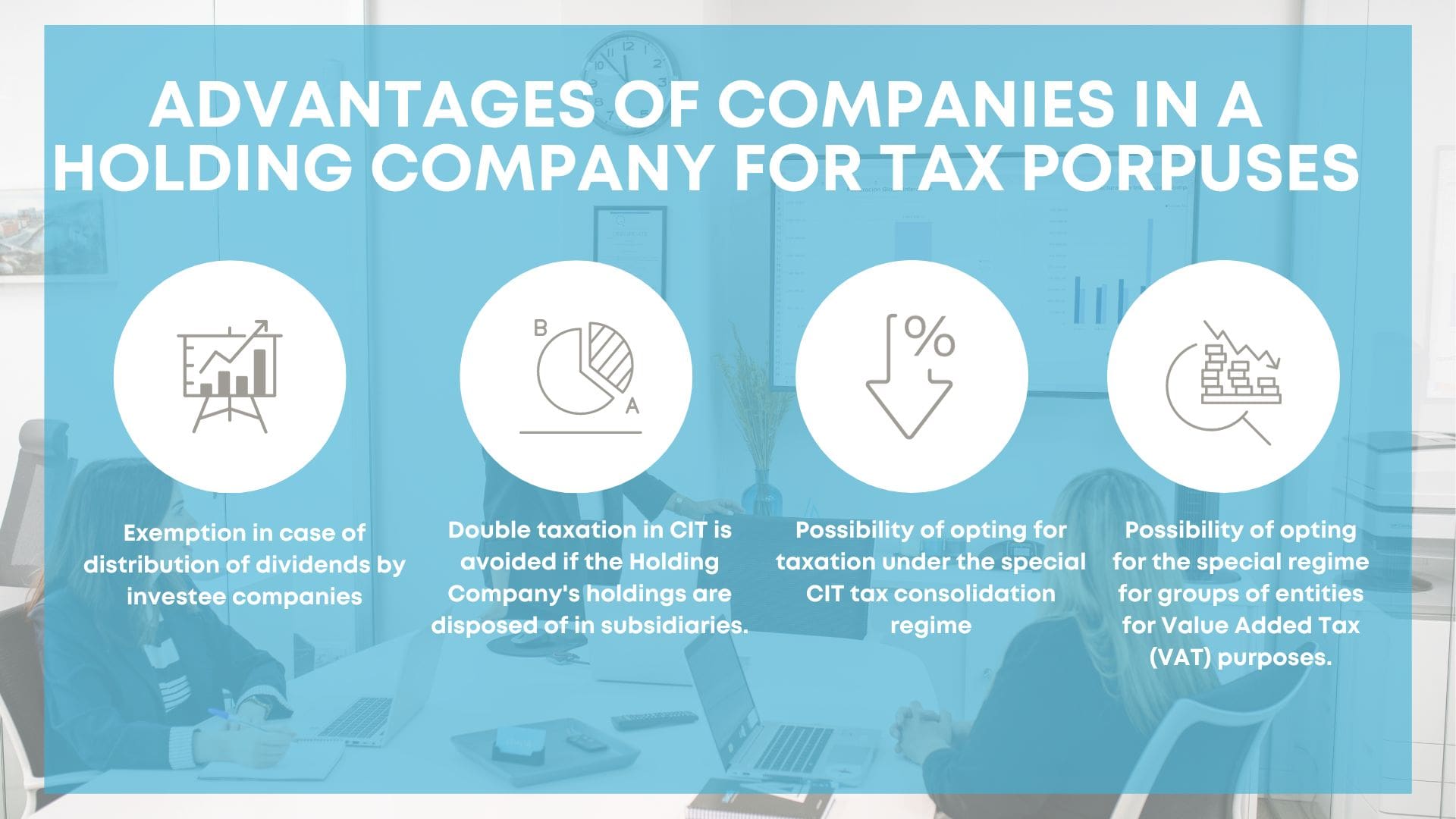

The tax advantages are:

- Exemption in the case of dividend distributions from investee companies.Dividends distributed by a subsidiary to its parent holding company are exempt, i.e., they are exempt from taxation in the holding company.Furthermore, there is no withholding tax on such distributions (as is when the shareholder receiving the dividend is an individual).Once the dividends have been placed in the holding company, whatever remains in the holding company allows new investments to be made or the financial needs of the subsidiaries to be met at zero cost.This system allows a company’s surplus to circulate upwards and downwards from the generating company to the holding company and from the holding company to the final recipient company at no cost.

- Double taxation in the IS is avoided if the Holding Company’s holdings are disposed of in the subsidiaries. The transfer of shares in a company by the holding company benefits from a total capital gains exemption.

- Possibility of opting to be taxed under the special IS tax consolidation regime.This means that the taxpayer will be the group as a unit, acting as a single taxpayer, and the holding company (parent company) will be responsible for the payment of the tax debt, allowing access to a series of advantages such as:

- The absence of withholding taxes on interest payments, dividends, or other income.

- The cancellation of intra-group results.

- Estimating the taxable base by the net result allows the profits obtained in companies with losses to be automatically offset.

- More accessible application of other deductions and allowances by setting out the conditions at the group level, thus offering more outstanding guarantees.

- Opting for the special regime for groups of entities for Value Added Tax (VAT) purposes.