Suppose you want to buy or sell your products or services outside the European Union. In that case, you must understand how VAT is levied on imports and exports to comply with VAT regulations and avoid inspections and penalties.

Many companies expand their market and buy and sell products outside the European Union. They analyze foreign suppliers to find products at very competitive prices. They place an order, and when the goods arrive at the Spanish customs, they are informed that they must pay an additional 40% on the price of the goods due to import duties and VAT. To avoid this kind of surprise and other costs, knowing how VAT is levied and calculated on imports and exports is necessary.

VAT on imports and exports

Import and export refer to purchasing or selling goods to non-EU countries. Therefore, a substance refers to the entry of goods into the EU from third countries, and an export refers to the supply of goods to a country outside the EU.

However, it is necessary to understand the impact of VAT in each case separately:

VAT on imports

When importing goods, several considerations should be taken into account:

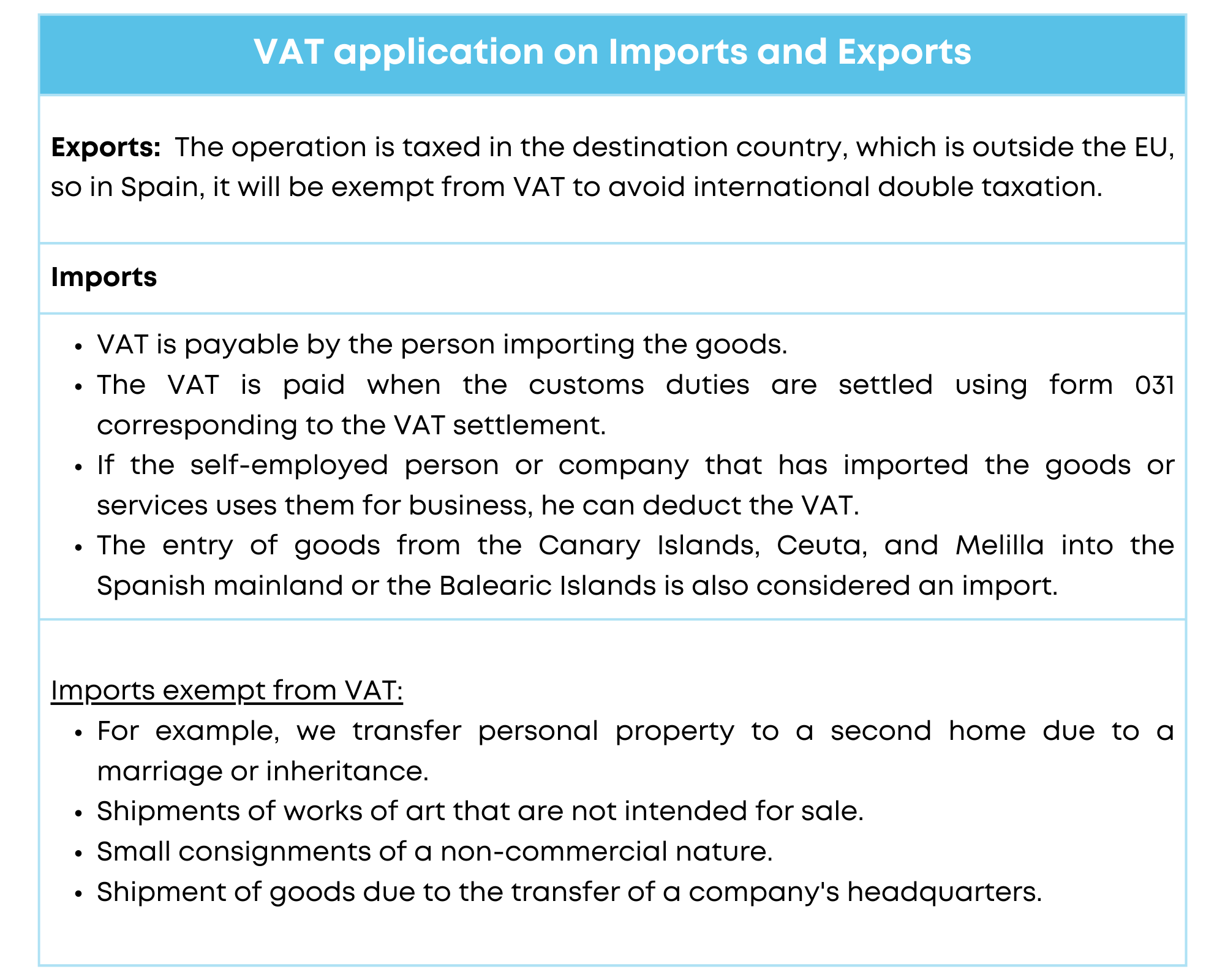

- According to Article 17 of the VAT Law, imports of goods are subject to tax, regardless of the purpose and the importer’s status.

- The person importing the goods, whether a company or a professional acquiring goods from a non-EU country, is responsible for paying VAT.

- VAT is paid when the customs duties are settled. The customs administration will send Form 031 for VAT settlement.

- If the operation is carried out by a self-employed individual or a company that will use the goods for its economic activity, the VAT paid can be deducted.

- The entry into the Spanish mainland or the Balearic Islands of goods from the Canary Islands, Ceuta, and Melilla is also considered an import. Even though they are Spanish provinces, it is understood that they are outside the customs territory of the EU.

- The following aspects shall be considered to calculate VAT on an import.

- The origin and classification of the goods.

- The customs value.

- The taxable base for VAT. This amount includes the price of the acquired goods and the expenses paid during the process (insurance, freight, duties, and other costs).

- The applicable VAT rate.

- VAT-exempt imports. The VAT Law regulates several cases in which the transaction is exempt from VAT. Some examples are given below:

- Transfer of personal belongings to a second home due to, for example, marriage or inheritance.

- Shipment of works of art not intended for sale.

- Small shipments without commercial character.

- Shipment of goods due to the relocation of a company’s headquarters.

VAT on exports

In the case of exports, the transaction is subject to taxation in the destination country outside the EU, so in Spain, it will be exempt from VAT to avoid international double taxation.