The Tax Agency is going to start a campaign to check that non-resident individuals are taxed on the properties they own in Spain. If you are a non-resident and you own a property in the country, check out this post to find out all you need to know about the non resident tax in Spain that apply to your case.

The first thing you should know is that non-resident foreigners and Spanish people who live abroad and own real estate in Spain must pay taxes on the properties they have in our country. For this, they must take into account the Real Estate Tax (IBI), the Non-Resident Income Tax (IRNR) and the Wealth Tax (IP).

How is it determined whether or not you are a resident in Spain?

Index of contents

If you own real estate in Spain and you want to know the taxation that applies to you, you must know whether or not you are considered to be a resident in the country for tax purposes. For an individual to be a resident in Spain, one of the following circumstances must be met:

- That he/she resides in Spain for 183 days or more during a year.

- That he/she has his/her main interests in Spain.

A taxpayer is presumed to be a resident in Spain when their spouses or minor children reside in Spain and depend on them.

Non-Resident Income Tax Taxation

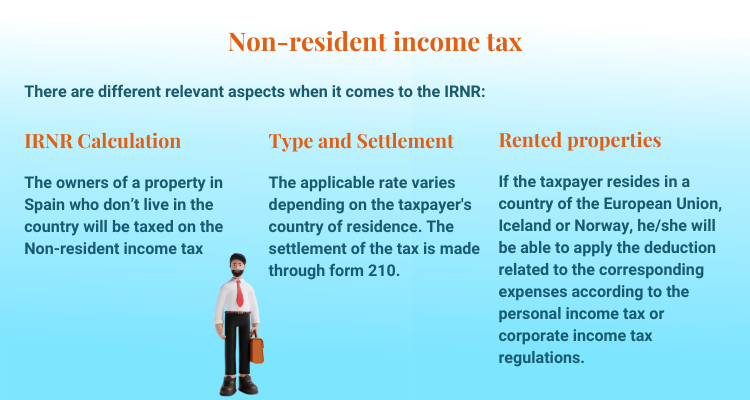

The following is an analysis of the most relevant aspects of the IRNR:

Calculation of the IRNR

People who don’t live in Spain but own real estate in the country are taxed under the Non-Resident Income Tax. In the case of individuals who own a property that is not rented or used for economic activities, the rules related to the imputation of real estate income regulated in the Personal Income Tax Law will be applied. Therefore, these taxpayers must declare the following income each year:

- 2% of the cadastral value of the property. The percentage is reduced by 1.1% when the cadastral value has been reviewed in the same tax period or in the ten previous periods.

- If the property doesn’t have cadastral value, or if the owner has not been notified, the imputation is 1.1% of 50% of the acquisition value or 50% of the value checked in other taxes, if higher.

We’ll see it below with an example:

Juan, a Spanish man who lives in Germany, acquired a property in Marbella on June 1, 2020, with a cadastral value of 200,000 euros, which was updated in 1999. In 2020 he had to declare the Non-Resident Income Tax for a yield of 2,345 euros. The calculation would be as follows:

200,000 euros x 2% x 214 days/365 days.

Type and Settlement

The applicable rate varies depending on the taxpayer’s country of residence. If the taxpayer resides in the European Union, Iceland or Norway, he/she must pay 19% of the presumed income. If the taxpayer resides in another country, the applicable rate is 24%.

The tax settlement is made through form 210 within a period that goes up to December 31 of the year following the year in which the income is imputed.

Rented properties

If the property is rented, it must be taxed for IRNR as follows:

- If the taxpayer resides in a country of the European Union, Iceland or Norway, he/she will be able to apply the deduction related to the corresponding expenses according to the IRPF or corporate tax regulations (depending on whether the taxpayer is an individual or a legal entity). If the taxpayer resides in other countries, no expenses may be deducted.

- The 60% reduction regulated in the IRPF for income from rental housing cannot be applied.

It is important to know that it is not possible to offset the positive income of one property with the negative income of another, nor is it possible to offset the negative income of one property with the positive income of the same property in subsequent years.

In this case, the applicable rate will also be 19% for residents of the European Union, Iceland or Norway, and 24% for residents of other countries.

The tax settlement is also made by means of form 210. When the balance is negative and, therefore, you need to pay, the settlement will be quarterly and it will have to be presented during the first 20 calendar days of the months of April, June, October and January.

If the result is zero, the settlement must be made between January 1 and 20 of each year.

Finally, if the result of the tax liquidation is a refund, the taxpayer must file the tax return from February 1 of the following year and always within four years from the end of the period of declaration or payment of the withholding.

If you have property in Spain and you don’t reside in the country, we can help you make the declaration of the income you receive. Our legal counsel will study your case in depth and will help you pay taxes in the best way.

Hello, I´m a resident of France, and I´ve got a house in Gernika which remains empty except for the summer months when I go there to spend my holidays. Do I´ve to pay tax on the ownership of this house even if I do not rent it? Best regards

Dear Amanda,

Both domestic legislation and double taxation treaties establish that regardless of whether the real estate is leased or not, as long as it´s located in Spanish territory, it´ll be taxed in Spain, in the case of Bikaia.

Non-resident individuals who own urban real estate (used for their use or empty) are subject to non-resident income tax. You must file an annual self-assessment (form 210) and pay the corresponding tax at any collaborating entity.Best redards