If you want to distribute dividends in your company, you may have doubts about how to do it, what types of distributions exist or how they are taxed. Keep reading this article and we will tell you all the details.

The first thing to be clear about is that a dividend is the profit that can be distributed, on an annual basis, among the partners and shareholders of a trading company. The partners or shareholders can be individuals or legal entities and the dividend they receive will be proportional to their stake in the share capital.

The right to the distribution of dividends is regulated in Article 93 of the Capital Companies Act, which establishes, as one of the rights of the shareholder, the right to participate in the distribution of the company’s profits and in the assets resulting from liquidation.

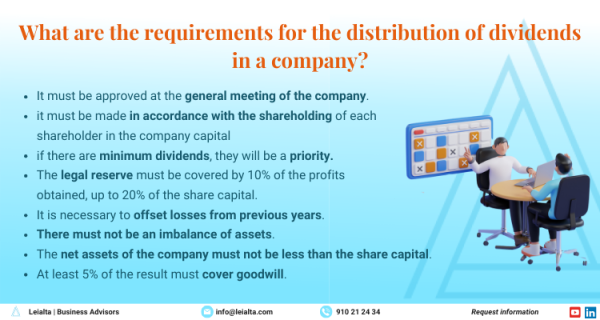

Requirements for the distribution of dividends to take place

When a shareholder contributes money to a trading company, in return, he expects to receive a profit, but in order to receive dividends, several requirements must be met, which are as follows:

- The distribution of dividends must be approved at the General Meeting of the company, as well as the form in which it is to be paid and the deadline. If these elements are not established, it is considered that the distribution will be made at the company’s registered office and after the resolution.

- The distribution, as mentioned above, must be made according to the share of each shareholder in the share capital, unless otherwise agreed in the articles of association.

- In the event that the articles of association have established minimum dividends for certain shareholdings, these shall have priority.

- The legal reserve must be covered by 10% of the profits obtained, until 20% of the share capital is reached.

- Losses from previous years must be offset before dividends are distributed.

- There must not be an equity imbalance. An imbalance occurs when accumulated losses leave the equity reduced to less than half of the share capital.

- Before and after the distribution of dividends the net assets of the company may not be less than the share capital.

- At least 5% of the result must cover goodwill.

If it is a case where the company distributes dividends out of the reserve, the requirements to be met are the same.

In the event that the requirements for distributing dividends detailed above are not met, the shareholders who receive the dividends must repay what they have received plus statutory interest.

What types of dividend distributions are there?

We can distinguish between various types of dividend distributions:

- Ordinary dividend distribution. This is the distribution that occurs periodically, e.g. annually, and refers to the profits obtained by the entity during a specific period of time.

- Extraordinary dividend distributions. These are cases in which the company receives an extraordinary profit, for example, because of the sale of a property owned by the entity, and it is decided to distribute the profits.

In addition to the two types of dividends we have seen, another classification is also made according to the way in which the dividends are distributed:

- Interim dividends. These are paid in cash to each partner or shareholder.

- Dividends in shares. In this case, no cash is distributed, but shares are distributed among partners or shareholders.

In relation to the above, we also speak of flexible dividends when it is the shareholder who decides how to receive the dividend.

Is it necessary to apply a withholding tax on dividend distributions?

The withholding tax to be withheld on dividends is 19%. This amount must be paid to the tax authorities. For example, if the shareholders receive a gross dividend of 15,000 euros, the amount of the withholding will be 2,850 euros.

On the other hand, the dividends received by the shareholders are taxed as income from movable capital and are added to the savings tax base. The scale applied, according to the General State Budget for 2023, is as follows:

- For income of less than 6,000 euros: 19%.

- For income between 6,000 euros and 50,000 euros: 21%.

- For income between 50,000 euros and 200,000 euros: 23%.

- For income between 200,000 euros and 300,000 euros: 27%.

- For income over 300,000 euros: 28%.

There are many details to take into account when it comes to the distribution of dividends, so in order to carry it out without any complications, it is best to enlist the help of expert business lawyers to help you with the case.

If you need to carry out a dividend distribution in your company, at Leialta we have a team of experts in company consultancy who will help you throughout the process, analysing the case, verifying that all the legal requirements are met and carrying out all the procedures in compliance with the law.