What is VAT and how does it work for businesses?

Index of contents

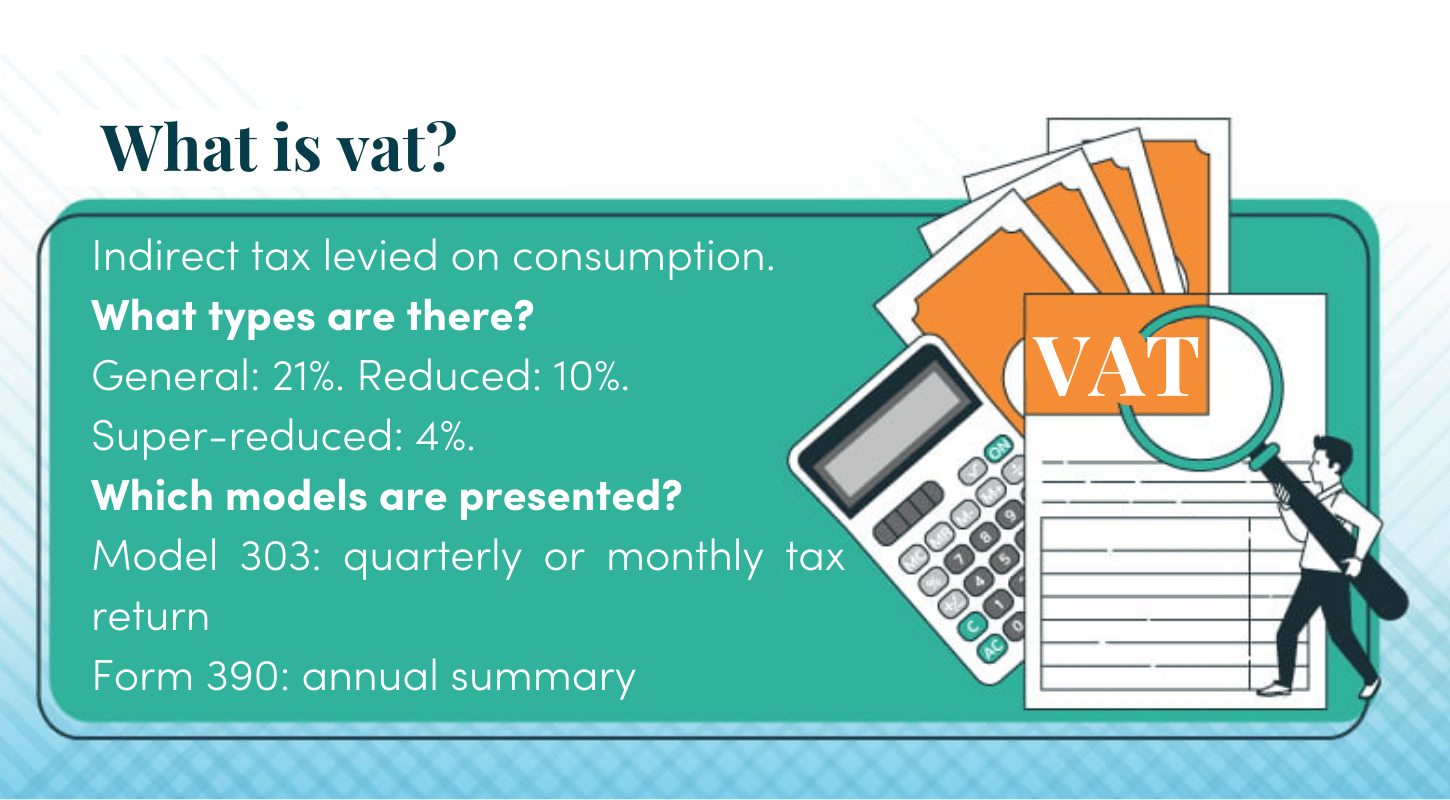

VAT or Value Added Tax is an indirect tax on consumption. It is essential to remember that it is a tax that is passed on to the end customer and that companies act as mere intermediaries, collecting the tax and paying it to the Treasury.

VAT affects businesses and self-employed persons engaged in non-exempt activities. This means that the vast majority of activities carried out by a company or self-employed person are subject to VAT.

Who is obliged to pay VAT to the tax authorities?

As we said before, in VAT, companies act as intermediaries, therefore, it is the companies and self-employed who must pay the VAT, which they pass on to their customers through their invoices, to the tax authorities. Therefore, the company issues the invoice with VAT, the end customer pays the invoice including VAT, and the company receives the VAT and pays it to the tax authorities.

What VAT rates are there?

There are three types of VAT:

– General rate. This is the VAT that applies to the vast majority of transactions subject to this tax, both sales and services. The general rate is 21%.

– Reduced rate. This applies to certain products or services such as the purchase of a newly built home, veterinary medicines, passenger transport and sporting events, among others. The reduced rate is 10%.

– Super-reduced rate. This applies to basic necessities such as basic foodstuffs in the shopping basket, subsidised housing and medicines, among others. The super-reduced rate is 4%.

How is VAT calculated and how is it done?

Knowing how to calculate the VAT that you are going to have to declare to the tax authorities is very easy, you simply have to calculate the VAT that you have charged on the invoices relating to the sales made by your company and the input VAT, i.e. the VAT on those invoices that you have received from your company’s suppliers for the purchases that you have made.

To make this clear, let’s describe two basic concepts:

– Output VAT. This is the VAT you charge your customers on your invoices, which can be 21%, 10% or 4%. For example, imagine that your fees for a transaction are 1,000 euros to which you have to add the 21% VAT (210 euros), so the total invoice is 1,210 euros. The part corresponding to VAT (210 euros) is what you will have to pay to the tax authorities later.

– Input VAT. This is the VAT that appears on the invoice from your company’s suppliers, both for products and services.

You know how to calculate VAT and now what do you do with the result? Two things can happen:

– The output VAT is higher than the input VAT, i.e. the VAT is positive. In this case, you will have to pay the VAT to the tax authorities.

– If the input VAT is higher than the output VAT, i.e. the VAT is negative. In this case, you will have to compensate, i.e. you will carry over the VAT from one quarter to the next and, at the end of the year, you will be able to request a refund from the tax authorities. There are also special regimes in which VAT is declared monthly and you can request a monthly refund if you need it, as we will see later on.

When is VAT paid? Deadlines for filing VAT returns

In general, all companies with a turnover of less than six million euros per year must file a quarterly VAT return in the months of April, July, October and January. The return must be filed by the 20th of each of these months if the result is negative or to be offset. If the return has a positive result and you want to pay by direct debit, remember that the deadline is reduced by five days. If you miss the deadline and want to pay the amount due by direct debit, you can do so by means of an NRC code that is managed by the bank.

If your company has a turnover of more than six million euros a year, VAT returns will be filed monthly and, in addition, you will have to apply the Immediate Supply of Information, which means that your VAT books will be kept through the Inland Revenue. In this case, the deadline for filing is the 30th of the following month and the deadline is reduced by five days in the case of direct debit, if you miss the deadline for direct debit you will also have to request the NRC code from the bank.

There is an exception to the general rule detailed above:

If you are a company with a turnover of less than six million euros, but you want to file the tax on a voluntary monthly basis, you can make use of the REDEME (Monthly Refund Regime). The great advantage of using this form of filing is that you will not have to wait until the end of the year to ask for a refund if you have a negative return.

Which forms are used to declare VAT?

Basically, two forms are used to declare VAT:

– Form 303: this is the one used for quarterly and monthly returns. Filing is compulsory and must be done electronically.

– Form 390: this is the annual VAT summary. The filing date is 31 January. There is no tax cost, but it is compulsory.

What happens if I file my VAT return after the deadline?

You already know what VAT is, when it is due and which forms to use, but what happens if you mistakenly fail to file your VAT return on time? There are two possible cases:

– You pay the tax debt after the deadline, but before the Treasury requires you to do so: in this case you will have to pay a surcharge of 5%, 10% or 20%.

– You do not pay the tax debt and the Tax Authorities require you to do so: in this case you are considered to have committed a tax infringement, which may be minor, serious or very serious. The penalty will be 50%, 100% or 150% of the amount that you did not declare.

Do I have to keep VAT invoices?

Businesses are obliged to keep invoices, documents and supporting documents even after filing the tax return for the relevant period. The statute of limitations for the tax is four years, so all documents must be kept for this period.

How do I recover the VAT refunded on a tax return?

If you want to recover VAT when a tax return is negative, you must wait until you file Form 303 for the fourth quarter. During the rest of the quarters you can only offset it against the following quarter. If you file monthly returns because you are obliged to do so or because you voluntarily apply for the REDEME, on the other hand, you will be able to request a refund every month.

The Treasury has a period of six months to analyse your case and return the money, so if you file your return in January, you will probably receive the refund in June. If you do not receive it within this period, interest will be charged for late payment.

In the event that you receive a request from the Tax Authorities, you must provide all the invoices requested electronically.

It may happen that the Tax Authorities decide to inspect you and for this reason it is best to be cautious and have all the documentation saved and in order. You can do the following:

– Always be prepared for an inspection.

– Have VAT Books with the declarations presented.

– Have all the invoices that appear in the VAT Books.

– Check that the amounts are correct and that you have deducted those that you can and should deduct.

As a consequence of all of the above, it is essential to have the help of a tax consultancy expert in business taxation to tell you how to declare the VAT, prepare the Forms and present them.